Adani Green’s 2030 Vision for Khavda Renewable Energy Park

Introduction

Adani Green Energy Ltd (AGEL) is one of the largest renewable energy producers enabling smooth green energy transition. The company is planning to invest Rs 1.5 trillion in probably the world’s largest renewable energy plant with a capacity of 30 gigawatts. The company aims to deliver reliable, clean and affordable power to the national grid.

Read on to learn more about the company and the investment options it has to offer.

Adani Green Energy Ltd Financial Analysis

AGEL is a large-cap company with a market cap of Rs 2,89,854 crores. The company is listed on key indices in the country like Nifty Next 50, Nifty 100, Nifty 200, Nifty 500, and S&P BSE 500. The company is going strong as Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) has reached Rs 10,462 crores in the fiscal year 2023-2024. This revenue growth can be attributed to the addition of 2,848 MW in greenfield capacity, consistent capacity utilization factor for the solar portfolio, and improvement in the wind and hybrid portfolio.

The following table gives a clear picture of the company’s growth in the past year.

| Metrics | March (2024) | March (2023) |

| Revenue From Operations | Rs 9,220 crores | Rs 7,792 crores |

| Gross Profit | Rs 8,033 crores | Rs 6,028 crores |

| Net Income After Taxes | Rs 971 crores | Rs 914 crores |

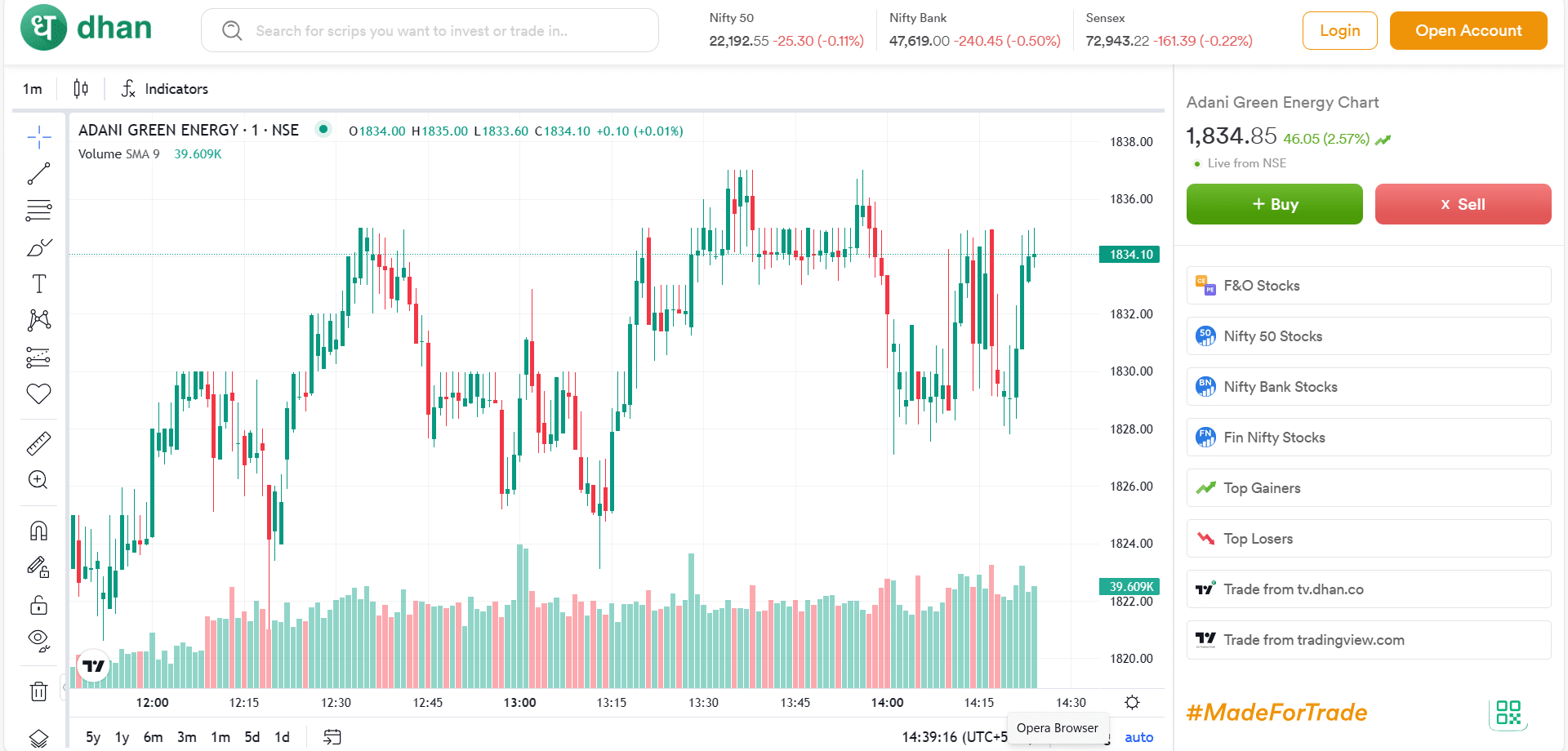

Adani Green Share Price Chart

The Adani Green share price chart shows the growth in the share price of the company.

Adani Green share price currently stands around Rs 1800+. Price to Book ratio stands at 17.07 whereas EPS is at Rs 6.94.

The company has shown consistent growth in the past. In the past 5 years, there has been a growth of 4803.07% in its share price and an increase of 68.99% in the past 3 years. For a broader perspective and as of the last trading session, Adani Green Energy gave a return of 64.4% as compared to the 55.23% return of Nifty 100.

As of March 2024, the company’s Promoter Holding stands at 56.37, Domestic Institutional Investors have a hold of 1.55, Foreign Institutional Investors stand at 18.15 and other investor holdings stand at 23.93.

Is it smart to invest in Adani Green Energy Ltd?

Renewable energy is the path forward as nations globally address the energy crisis. Adani Green Energy Limited aims to achieve a goal of 45,000 MW of renewable energy by 2030. The company has created over 32,000 green jobs and aims to install the world’s largest solar plant of 30,000 MW at Khavda, Gujarat.

The stock is in a strong bullish trend for long-term and short-term investors. Therefore, investors can go long on the shares if they fit their goals and risk profile.

Conclusion

AGEL’s ambitious vision for the Khavda Renewable Energy Park reflects the company’s commitment to sustainable energy. Such projects aim to contribute to the country’s renewable energy targets and make it a global leader. The Khavda Renewable Energy Park stands as the epitome of the company’s dedication to creating a more sustainable future.

Follow Dhan for more updates and invest in stocks.